Over the last few months, the financial media has been full of negative headlines, which can leave one concerned given their relentless nature.

Whether it’s the rise in the energy price cap and the rate of National Insurance contributions (NICs), the increasing cost of goods and services, or the impact of stock market volatility on your pensions or investments, there is no doubt it’s been a tricky 2022 so far.

It’s natural to feel nervous or worried when national or global events are having a detrimental effect and are beyond our control and we wouldn’t be human if this didn’t affect us all from time to time.

2022 has seen a combination of events, and while these the issues may be different each time, the story for the long term investor (i.e. you) remains the same; firstly, short term events cannot be predicted and secondly, they will not affect your long term wealth, as long as you remain invested during the more testing times.

Read on to find out more about how markets have fared so far in 2022, and three practical things to remember during difficult periods.

Markets have endured a volatile start to 2022

With the exception of the UK FTSE All-Share index, global stock markets have mostly seen a downturn at the start of 2022.

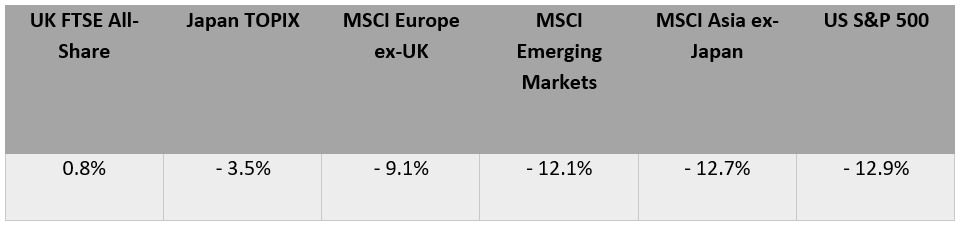

The table below shows the performance of a range of regional indices between January and the end of April 2022.

April was particularly tough in US markets. CNBC report that the Nasdaq fell about 13.3% in April, its worst monthly performance since October 2008; the height of the global financial crisis.

The S&P 500 lost 8.8%, its worst month since March 2020 (the onset of the Covid pandemic), while the Dow Jones fell by 4.9%.

Of course, different regions have reacted differently to the current issues.

This is one reason it’s important to hold a diversified portfolio, as falls in one region can be offset by rises elsewhere. While US markets may have fallen, the FTSE 100 is broadly at the same level it started 2022, helping to balance the performance of your portfolio.

If you’re concerned, here are three things to always remember during uncertain times. We hope they may help you to manage any anxiety you have about your finances.

1. Cash is not always king

In times of volatility, it can be tempting to exit the stock market altogether and move your money into cash savings. Keeping your money in the bank or building society might reassure you that it won’t “lose” value.

However, there are two important points to bear in mind.

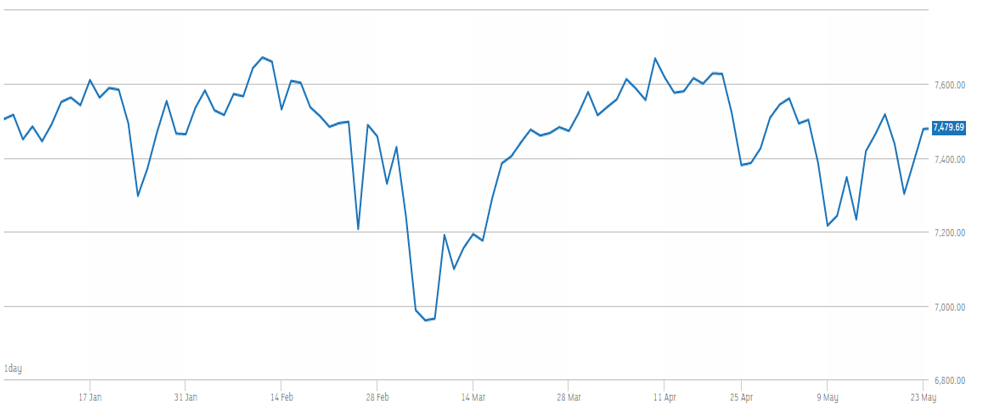

Firstly, if you sell your investments during a downturn, you are effectively turning a paper loss into an actual loss. Here’s the performance of the FTSE 100 from the start of January to 23 May 2022.

Source: London Stock Exchange

If you’d decided to sell and exit the market at the start of March, you’d have missed out on the subsequent growth in April and May.

Secondly, while you may not “lose” money by keeping your wealth in cash savings, you are almost certainly eroding its value in real terms.

The latest Office for National Statistics (ONS) data shows UK inflation reached 9% in April. Compare this to the highest interest rate you can receive on easy-access cash savings in May 2022 which, according to analysts Moneyfacts, is just 1.25%.

- If you save £100,000 at 1.25% you’ll earn £1,250 interest, so your cash in a year will be worth £101,250.

- If inflation remains at 9%, £100,000 worth of goods and services now will cost £109,000 in 12 months’ time.

- In real terms, keeping your wealth in cash has hugely eroded its buying power.

While it’s important to keep some money in cash – we can work with you to establish exactly how much – keeping too much in cash can slow your progress towards your long-term goals.

2. The temporary dips that most stock markets have gone through are completely normal

While the reasons behind the dips in many stock markets may vary each time, these events are something that you, as a long-term investor, will have gone through several times before and will, almost certainly, go through again.

We know that the average annual market fall from a high to a low in the S&P 500, the largest and arguably most important stock market in the world, has for many decades been about 14%. Despite this, this market and others globally have generally achieved a positive return for roughly three out of four years, thus rewarding the resolute investor. The rewards for those who can see through the news stories and remain patient are positive returns and the protection of the real value of assets.

Furthermore, we know that around once in every five years there will be a greater fall, which is called a ‘bear market’ by the press. No one can predict when these events will happen, but we can observe that each time they have occurred, markets have corrected and fully recovered.

Your portfolio might continue to be invested for another 10, 20 or 30 years, and then quite possibly beyond your own lifetime, so the performance of the stock market in May 2022 is part of a recurring pattern which, in the overall scheme of things, is not going to make a difference to your long-term financial security.

Better to have faith in the great companies of the world, who continue to innovate, grow and return profits to you, as a stakeholder in these companies.

3. Investing after a downturn could provide rewards

Warren Buffett, seen as one of the world’s leading investment gurus, has a useful quote for periods of economic uncertainty: “Be fearful when others are greedy, and greedy when others are fearful.”

What he means is that investing in a falling market can offer benefits when markets recover which, history tells us, they almost always do.

It’s impossible to guess when the bottom of the market is, even for experienced fund managers. Instead, we retain the core belief that owning a slice of the best companies of the world in a globally diversified portfolio is the best protection against the enemy of inflation.

We’re here to help

Another famous investor, Benjamin Graham once said: “The investor’s chief problem – even his worst enemy – is likely to be himself.”

When times are uncertain it’s easy to act on emotion. Your behavioural biases kick in, and you might feel inclined to make knee-jerk decisions that can impact your long-term goals.

That’s why we are here. We can chat through the current situation with you, review your goals, and give you the reassurance that you’re on course. And, if you’re not on track, we can take steps to ensure your goals remain attainable.

If you would like to chat to us about the current uncertainty, please get in touch.

Please note

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance