Since the start of 2022, you’ve probably noticed that global markets – and perhaps the value of your pension or investments – have been more volatile than we saw in 2021.

Over the last week or two, the ongoing situation in Ukraine has exacerbated this volatility.

It’s natural to feel nervous or worried when national or global events have a direct influence on your wealth. In recent weeks, there have been a number of events that have conspired to unnerve markets around the world, including:

- The Russian invasion of Ukraine

- Rising inflation across the developed world

- Steep rises in the cost of energy for both domestic and business customers

- Ongoing Covid concerns

- Continuing global supply chain issues.

Read on to find out more about how markets have fared so far in 2022, and three helpful tips in case you are feeling concerned during a difficult period.

Markets have endured a volatile start to 2022

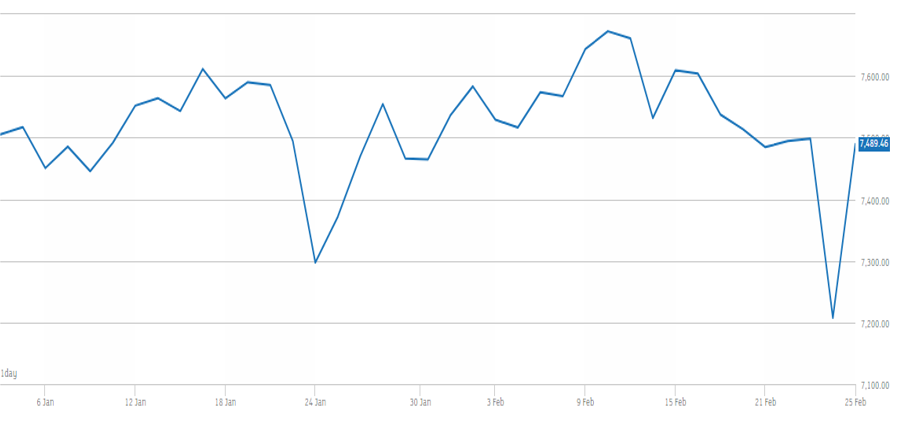

Since the turn of the year, markets have been noticeably jittery. Between 1 January and 26 February 2022, the US S&P 500 index fell by around 8%, while the German DAX fell by around 9% in the same period.

Despite falls in some markets, it’s interesting to note that, while the UK stock market may have been volatile in 2022 to date, the FTSE 100 is broadly at the same level it was at the start of 2022 – even with everything that’s happened on the global stage.

You can see this in the chart below, that shows the performance of the FTSE 100 from 1 January to 26 February 2022.

Source: London Stock Exchange

However, with experts currently predicting a protracted war in Ukraine alongside an inflation rate not seen for decades, it’s likely that a tricky few months lie ahead.

So, here are three tips that may help you manage any anxiety you may have about your finances.

1. Try not to panic

Imagine the value of your home had fallen by 10%. What would you do?

Would you immediately panic, worry about potential further erosion of value, and sell your home straight away?

Or would you remain patient, trust that markets generally tend towards growth, and wait until prices recover?

It’s almost certain you’d take the second path. This is also a good way to think about the value of your pensions, ISAs, shares, and investments.

We only have to go back a couple of years to see this in action.

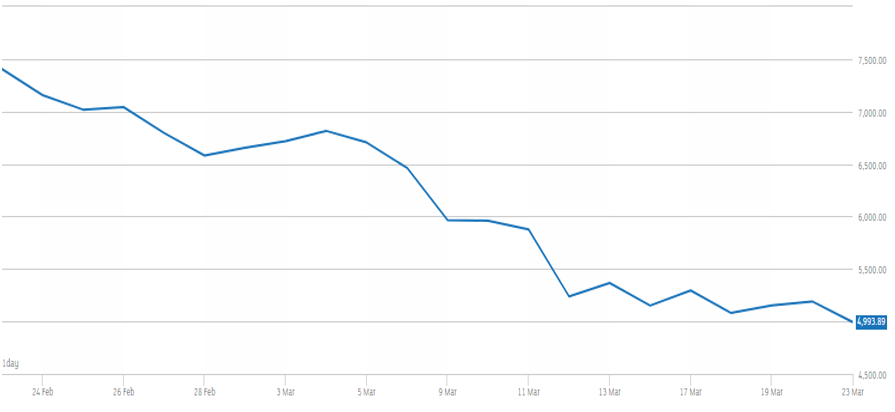

One of the immediate effects of Covid-19 arriving in the UK, and the first national lockdown, was that the UK stock market fell sharply. Between 21 February 2020 and 23 March 2020, the value of the FTSE 100 fell by just under a third, as the chart below shows.

Source: London Stock Exchange

Had you sold your investments at the bottom of the market and continued to hold cash for a long period of time, you’d likely have crystallised a significant loss.

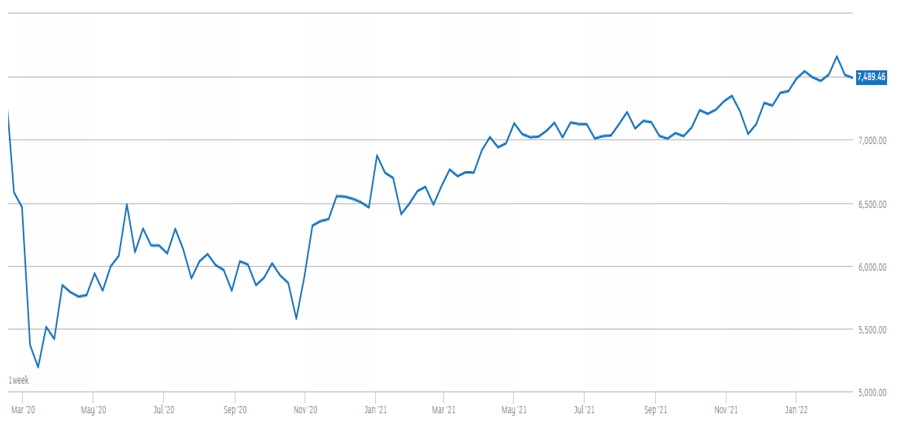

However, had you remained patient, the FTSE 100 had recovered to its February 2020 level by the winter of 2021 – less than two years later.

Source: London Stock Exchange

The lesson here is that, over time, markets typically recover. You may have to remain patient, but cashing in equities after a market fall will simply turn a paper loss into an actual loss.

2. Don’t check the value of your portfolio every day

In periods of uncertainty, you may check the value of your investments more regularly than usual. It’s a perfectly natural reaction to volatility.

However, this often only increases your anxiety and worry and can magnify sharp moves in the markets.

For example, the FTSE 100 fell by 3.8% on 24 February – the day Russia invaded Ukraine – but rose by almost 4% the following day.

You also have to consider that your investments are diversified across sectors and countries. So, hearing a negative headline about the FTSE 100 on the BBC News won’t necessarily reflect what’s happened to the value of your own assets.

That’s because you’ll likely be invested in dozens of countries and hundreds of companies around the globe. Diversification helps to mitigate a fall in one area because it can be balanced by growth in another.

In a world of rolling 24-hour news, it can be hard to “drown out the noise”, but resisting the temptation to check the value of your assets every day can help you ride out periods of uncertainty.

3. Focus on your long-term goals

While you may be concerned about the short-term volatility of markets, it’s important to remain calm and stay focused on your goals.

Whenever you invest in equities, short-term volatility is something that you should expect and accept. Everything from the Budget to global geopolitics can affect what happens to markets around the world. On any given day or week, prices will fluctuate in the short term.

However, in the long term – and that’s what we focus on – markets tend to offer positive returns.

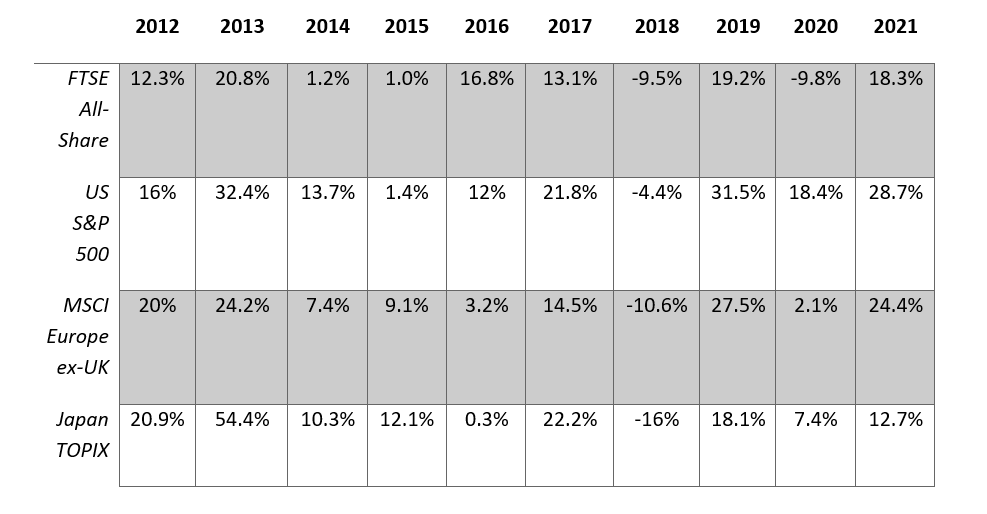

Here’s a useful summary of the annual return of some of the major stock indices over the 10 years to 2021. It shows that, with one or two exceptions, stock markets over the last decade have tended to produce positive annual returns – even in the light of Brexit, economic uncertainty and Covid-19.

Of course, the value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Source: JP Morgan, FTSE, MSCI, Refinitiv Datastream, Standard & Poor’s, TOPIX, J.P. Morgan Asset Management. All indices are total returns in local currency, except for MSCI Asia ex-Japan and MSCI EM, which are in US dollars. Past performance is not a reliable indicator of current and future results. Data as of 31 January 2022.

If your long-term goals haven’t changed, it’s unlikely that your plans should.

Your goals are likely to be the same as they were a week or a month ago. We design our investment strategies with the long term in mind, and this naturally considers periods of both positive and negative returns.

We’re here to help

One of the ways we can help you achieve your goals is by acting as a “sounding board” during periods of instability. We’re here to help you avoid making knee-jerk decisions that can impact your long-term goals.

If you would like to chat to us about the current uncertainty, please get in touch.

Please note: The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.